The News Editorial Analysis 2nd February 2022

5G services to roll out in FY23: Sitharaman

Union Finance Minister Nirmala Sitharaman on Tuesday said the government would auction telecom spectrum in 2022, which will facilitate private players to roll out 5G services before March 2023.“Telecommunication in general, and 5G technology in particular, can enable growth and offer job opportunities,” the Minister said in her Budget speech. “Required spectrum auctions will be conducted in 2022 to facilitate roll-out of 5G mobile services within 2022-23 by private telecom providers,” she added.Speaking to reporters later, Telecom and IT Minister Ashwini Vaishnaw said the Telecom Regulatory Authority of India was deciding its recommendations for the spectrum auction and these were expected by March. “As soon as the recommendations come, we can go ahead with the auction.”Ms. Sitharaman said to enable affordable broadband and mobile service proliferation in rural and remote areas, 5% of annual collections under the Universal Service Obligation Fund (USOF) would be allocated. This would promote R&D and commercialisation of technologies,.

BSNL to get ₹44,720 cr.

The government will make a capital infusion of ₹44,720 crore in state-owned BSNL in 2022-23 — the majority of the telecom ministry’s estimated capital expenditure, Budget documents show. “The provision is for capital infusion for 4G spectrum, technology upgradation and restructuring in BSNL.

‘Unchanged tax slabs disappointing’

The Finance Minister’s Budget Speech was a short one, and she made only a handful of references to the direct tax changes envisaged. Nonetheless, the Finance Bill is a detailed one, and contains several important, albeit low-key amendments on the direct tax front.On the all-important topic of personal tax rates, the Budget contains no major changes. This will come as a disappointment to many who were expecting relief from changes to slabs, a lowering of rates, or at least through an increase in key tax deductions. Some benefit by way of COVID relief is, however, provided both in respect of treatment costs as well as in respect of sums paid to family members of those who passed away in the pandemic. In a sense, with strong domestic demand and the looming threat of inflation, perhaps the government chose to adopt a wait-and-watch approach towards tax relief, despite the imminent elections in key States. However, this is something that the government may have to consider in the coming years, especially if tax collections continue to remain buoyant.On the procedural side, there is an important change that will enable taxpayers to update their returns beyond the short existing time limits for filing belated returns. This will now be possible up to 2 years from the end of the assessment year, but comes with a cost — the taxpayer has to pay an additional tax between 25% and 50% on the additional income declared in the updated return. This is a far reaching change, and will enable taxpayers to address inadvertent errors and obtain certainty without going through a complex and time consuming litigation process.For businesses, the tax proposals are something of a mixed bag. On the positive side, extensions have been provided for start-ups and new manufacturing companies. Start-ups established up to March 31, 2023 (instead of March 31, 2022) will now be eligible for tax relief.Similarly, to avail of the concessional 15% tax rate, new manufacturing companies had to commence manufacture by March 31, 2023. This date has been extended to March 31, 2024.On the other hand, the scope of TDS has been extended to benefits or perquisites arising in the course of business. Last year, a new provision was introduced requiring a higher rate of withholding on payments made to persons who had not filed their income tax returns for both years preceding the year of payment. This provision is being made more rigorous by restricting the testing period to one year. In fact, over the past few years, the scope of TDS provisions has been gradually increasing. Many taxpayers have expressed concern over this trend and suggested that the scope of TDS on domestic payments should be curtailed since this imposed significant compliance costs and led to significant litigation. The current amendments could add to this burden. Another important change is the withdrawal of the concessional 15% rate available in respect of dividends earned from foreign subsidiaries. Such dividends will now be taxed at normal rates. Certain important changes relating to deductibility of expenses are also proposed. Education cess has been made expressly non-deductible, retrospectively from 2004-05. The Budget also provides a detailed set of rules for taxing virtual digital assets, which would include crypto currencies and Non Fungible Tokens (NFTs). Gains from their transfer have been subject to a flat tax rate of 30% with no deduction for any expenditure (other than cost) or any set off of losses.TDS on payments for their transfer has also been introduced, and provisions relating to gifts have been expanded to include them. The restriction on set-off of realised losses against gains is unusual, considering that income tax law has long allowed set off and carry forward of losses in speculative businesses, albeit with a restriction that such losses can be used only against speculative profits. It is not clear why this principle could not be applied to virtual assets.

FM retains tax slabs, allows updated returns

Revised returns may be filed within two years of end of the relevant assessment yearThe Union Budget 2022-23 has kept income tax slabs unchanged while allowing tax payers an additional two years to update their returns.Union Finance Minister Nirmala Sitharaman on Tuesday while presenting budget proposals said the government’s objective was to further simplify the tax system, promote voluntary compliance by taxpayers, and reduce litigation.She introduced the ‘Updated return’ option to provide taxpayers an opportunity to ‘correct errors’ while filing returns or not having reported certain transactions. “I am proposing a new provision permitting taxpayers to file an Updated Return on payment of additional tax. This updated return can be filed within two years from the end of the relevant assessment year,” .

‘Trust reposed in payer’

With this proposal now, there will be a trust reposed in the taxpayers that will enable the assessee herself to declare the income that she may have missed out earlier while filing her return, she said. To bring parity between employees of State and central governments, she has proposed to increase the tax deduction limit from 10% to 14% on employer’s contribution to the National Pension System (NPS) account of State Government employees as well. This would help in enhancing the social security benefits of State government stff and bring them at par with central government employees.To establish a globally competitive business environment for certain domestic companies, a concessional tax regime of 15% tax was introduced by our government for newly incorporated domestic manufacturing companies.The FM has prosed to extend the last date for commencement of manufacturing or production under section 115BAB by one year i.e. from March 31, 2023 to March 31, 2024.She has also proposed to cap the surcharge on long-term capital gains arising on transfer of any type of assets at 15%, from graded surcharge of up to 37% currently. To track transactions involving businesses passing on benefits to their agents, the budget has proposed to provide for tax deduction by the person giving benefits, if the aggregate value of such benefits exceeds ₹20,000 during the financial year.It also proposed to reduce customs duty on cut and polished diamonds and gemstones to 5%. Simply sawn diamonds would attract nil customs duty. To disincentivise import of undervalued imitation jewellery, customs duty on imitation jewellery has been imposed.The Minister proposed to reduce customs duty on methanol, acetic acid and heavy feed stocks for petroleum refining, while duty is being raised on sodium cyanide for which adequate domestic capacity exists. “These changes will help in enhancing domestic value addition,” she said.Duty is being reduced on certain inputs required for shrimp aquaculture so as to promote its exports.To encourage the efforts for blending of fuel, unblended fuel shall attract additional differential excise duty of ₹2/ litre from the October 1, 2022.

Cooperative societies get tax, surcharge relief

Alternate Minimum Tax slashed to 15%The Centre, in the Union Budget 2022-23, has slashed the alternate minimum tax rate and surcharge for cooperative societies to provide them a level-playing field with companies.Currently, cooperative societies are required to pay Alternate Minimum Tax at the rate of 18.5%. However, companies pay the same at the rate of 15%.“To provide a level-playing field between co-operative societies and companies, I propose to reduce this rate for the cooperative societies also to 15%,” Finance Minister Nirmala Sitharaman said, announcing her Budget proposal on Tuesday.Ms. Sitharaman also proposed to reduce the surcharge on cooperative societies from the present 12% to 7% for those having a total income of more than ₹1 crore and up to ₹10 crore.“This would help in enhancing the income of cooperative societies and its members who are mostly from the rural and farming communities,”.

Defence outlay witnesses marginal increase

Finance Minister announces steps to boost domestic manufacturing, reduce imports

Continuing the push for Make in India in defence, the Government on Tuesday announced additional measures to boost domestic manufacturing and reduce imports, while the total allocation for defence in the Budget has gone up marginally to ₹5.25 lakh crore.This is 4.43% higher than the revised estimates of last year and 9.8% higher over the Budget estimates of last year.Finance Minister Nirmala Sitharaman announced that defence Research and Development (R&D) will be opened up for industry, start-ups and academia with 25% of R&D budget earmarked for them. Capital allocation for R&D stood at ₹11,982 crore for 2022-23.“Private sector will be encouraged to take up design and development of military platforms and equipment in collaboration with DRDO and other organisations under special purpose vehicle (SPV) model,” Ms. Sitharaman said in her Budget speech.“An independent nodal umbrella body will be set up for meeting a wide ranging testing and certification requirements.”The allocation of ₹5.25 lakh crore constitutes 13.31% of the total Union Budget 2022-23 which envisages a total outlay of ₹39.45 lakh crore, a Ministry statement said. Of the ₹5.25 lakh crore, the revenue allocation is ₹2.33 lakh crore, capital allocation stood at ₹1.52 lakh crore and defence pensions at ₹1.19 lakh crore.Within this, of the ₹1.52 lakh crore capital allocation which is meant for new purchases and paying for past procurements, 68% or ₹84,598 crore from the allocation for the three Services would be reserved for procurement from domestic industry, Ms. Sitharaman announced. In last year’s Budget, ₹70,221 crore of the capital allocation, which is about 63%, was reserved for the domestic industry.Last year, the defence Budget saw a major increase in the backdrop of the standoff with China in Eastern Ladakh and the Services had also made several emergency procurements in the second half of 2020.In contrast, the Budget data show for 2021-22, the Army had returned around ₹11,100 crore while the Navy got an additional allocation of ₹12,767.99 crore compared with the Budget estimates to the revised estimates. Overall, the Navy’s capital allocation shows an year-on-year increase of more than 43% going to 47,591 crore which the MoD said is “aimed at acquisition of new platforms, creation of operational and strategic infrastructure, bridging of critical capability gaps and building a credible maritime force for the future.”The Army got ₹32,015 crore and Air Force ₹55,586 crore for 2022-23 under the capital budget. Overall, the capital allocation saw an increase of 12% compared with the Budget estimates of last year. Atul Keshap, president U.S.-India Business Council said the 12% increase in the capital Budget expenditure for defence will help support India’s border security and Indo-Pacific ambitions.“Still, increasing targets for indigenisation of production may slow India’s access to the equipment it needs to safeguard its security. Making India a more friendly manufacturing environment for international defence companies will be critical if they are to supply India’s defence needs in a prompt manner.”

‘It will lead to a cheaper currency management system’In a big ‘no’ to cryptocurrencies, the digital rupee will be introduced in India during the financial year 2022-23, Union Finance Minister Nirmala Sitharaman said on Tuesday while presenting the Union Budget.“Introduction of Central Bank Digital Currency will give a big boost to the digital economy. Digital currency will also lead to a more efficient and cheaper currency management system,” Ms. Sitharaman said.“It is, therefore, proposed to introduce the digital rupee, using blockchain and other technologies, to be issued by the Reserve Bank of India starting 2022-23.”“Digital rupee is one of the most-awaited announcements. It is important to understand how other crypto assets will be taxed and whether there will be any specific benefit given to the digital rupee,” said Pranay Bhatia, partner and leader, tax and regulatory services, BDO India.“With no deduction for cost, tax rate at 30%, tax on mining/gifting and no offset of loss against income from other sources, the Finance Minister has given the much-needed clarity on crypto transactions. However, tracking such transactions in the absence of a central regulator may be challenging,” .

16% hike in healthcare sector allocation

However, the ₹83,000-crore outlay is almost equal to last year’s actual spend; zero allocation for emergency response fundThe government perceives the pandemic to be in retreat, going by Union Finance Minister Nirmala Sitharaman’s Budget speech as well as a perusal of the Budget documents.In 2021-22, the Budget documents show, the Centre ended up spending ₹82,920 crore — nearly ₹11,000 crore more than the Budget estimate. This was largely in the form of ‘grant in aid’ to States.It proposes to spend around the same — ₹83,000 crore — over the coming financial year. The 2022 Budget estimate is nearly 16% more than the ₹71,000 crore budgeted last year.Further evidence that COVID-19 is seen as a diminished threat this year comes from allocation to a budgetary head called “India COVID-19 Emergency Response and Health System Preparedness” that saw an allotment of ₹12,359 crore last year but has seen zero allocation in the present year.In her address, however, Ms. Sitharaman stressed the need for improving access to mental healthcare facilities via telemedicine and digital healthcare facilities.Her speech did not mention vaccines, bettering hospitals, improving public health facilities — all major points that found mention in the previous two years.“I recognise we are in the midst of an Omicron wave, with high incidence but milder symptoms. Further, the speed and coverage of our vaccination campaign has helped greatly. With the accelerated improvement of health infrastructure in the past two years, we are in a strong position to withstand challenges. I am confident that with sabka prayas (everybody’s effort), we will continue our journey of strong growth,” Ms. Sitharaman said in her opening remarks.As of Monday, India has double vaccinated more than 75% of its eligible population, even as it posted close to 1,67,000 new cases in the past 24 hours.While allocations have not been hiked, the Centre also expects to spend the same as it did last year on health research.In 2021-22, the Centre allotted ₹2,663 crore for health research but spent ₹3,080 crore. This year, it has budgeted ₹3,200 crore.The capital expenditure that the Health Ministry expects to make in the coming year is ₹5,632 crore or about ₹1,000 crore less than what was spent last year.The Pradhan Mantri Ayushman Bharat Health Infrastructure Mission (PMABHIM) has seen a substantial increase from ₹585 crore last year to ₹4,177 crore this year. A scheme to improve pandemic preparedness via research and development as well as strengthen “bio security” has also been hiked from ₹140 crore to ₹690 crore.

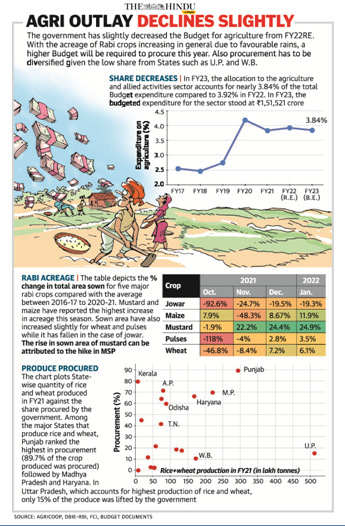

Agri-tech: drones, start-up fund in focus

A scheme through public-private partnership to be launched for farmersThe emerging agri-tech sector has been enthused by the abundance of digital farming references in the Union Budget speech on Tuesday.“For delivery of digital and hi-tech services to farmers with the involvement of public sector research and extension institutions along with private agri-tech players and stakeholders of agri-value chain, a scheme through PPP [public-private partnership] mode will be launched,” said Finance Minister Nirmala Sitharaman.She added that a fund with blended capital, raised under the co-investment model, would be facilitated through NABARD. “This is to finance start-ups for agriculture and rural enterprise, relevant for farm produce value chain. The activities for these start-ups will include, inter alia, support for FPOs, machinery for farmers on rental basis and technology, including IT-based support,” said Ms. Sitharaman.With a wider focus on drone technology, the Minister promised to promote the use of “kisan drones” for crop assessment, digitisation of land records, and spraying of insecticides and nutrients on fields. In fact, the Budget speech emphasised the efficient use of land resources via technology. “States will be encouraged to adopt Unique Land Parcel Identification Number to facilitate IT-based management of records. The facility for transliteration of land records across any of the Schedule VIII languages will also be rolled out,” she said.“The adoption or linkage with National Generic Document Registration System (NGDRS) with the ‘One-Nation One-Registration Software’, will be promoted as an option for uniform process for registration and ‘anywhere registration’ of deeds and documents,” said Ms. Sitharaman.“The expansion of technology focus from just tractors and agri-machinery to ‘kisan drones’ shows a rising interest in the application of IOT in the sector,” said AgroStar CEO Shardul Sheth.

Record allocation of ₹1.37 lakh cr. for Railways

Focus on capacity expansion, safety; 400 new-generation Vande Bharat trains to be manufactured in next three yearsThe Union Budget has proposed a record budgetary allocation of ₹1.37 lakh crore for the Indian Railways, with capital expenditure outlay of over ₹2.45 lakh crore for the upcoming financial year. With a 14% higher capital expenditure over last year, the national transporter plans to utilise the funds to complete key stalled projects and enhance passengers amenities and safety.

Finance Minister Nirmala Sitharaman on Tuesday also announced that 2,000 km network will be brought under Kavach — an indigenous technology developed for safety, in 2022-23, and 400 new-generation Vande Bharat trains with better energy efficiency and ride experience will be developed and manufactured during the next three years.Terming the allocation as ‘historic’, Railways Minister Ashwini Vaishnaw told reporters that with the increased allocation, the focus will be on capacity expansion and enhancement of security, along with ‘supercritical’ projects.

98% operating ratio

Mr. Vaishnaw said for the upcoming fiscal, the Railways is targeting a 98% operating ratio, but he is hopeful of bettering this on the back of improved freight performance.The operating ratio indicates how much the Railways spends to earn a rupee.“We are targeting 98% operating ratio in the coming year. But I think we should be able to achieve more than this… We are already achieving over four million tonne loading everyday… which is unheard of… We are now targeting freight loading of 4.5 MT everyday consistently and then move on to 5 MT/day gradually,” he said.To a query on the Vande Bharat trains, he said, “The current Vande Bharat under operation is version 1. For version 2.0, the designing is complete and testing will begin in April. We plan to start serial production of these September onwards… Today’s target will see even better versions of this train.”On the proposal to bring 2,000 km network under Kavach, the Minister pointed out that it is SIL4 (Safety integrity level) certified which means there is the probability of a single error in 10,000 years.Ms. Sitharaman said the Railways will develop new products and efficient logistics services for small farmers and Small and Medium Enterprises, besides taking the lead in integration of postal and Railways networks to provide seamless solutions for movement of parcels.

One Station-One Product

She also announced the ‘One Station-One Product’ concept will be popularised to help local businesses & supply chains, and 100 PM GatiShakti Cargo Terminals for multimodal logistics facilities will be developed during the next three years.

As per the Budget documents, the Railways expects receipts comprising revenues from passenger, goods, other coaching, sundry other heads etc, to be ₹2.40 lakh crore in BE 2022-23 as against RE 2021-22 of ₹2.02 lakh crore. It expects passenger revenue of ₹58,500 in 2022-23, and goods revenue to be about ₹1,65,000 crore.Vishnu Sudarsan, Partner, J. Sagar Associates (JSA), added that the railways sector, which boasts a wide-reaching network and is a lynchpin of keeping crucial supply chains operational, can play a clinching role in India’s logistics growth story and meeting the climate change and sustainability goals. “However, in order to ensure a starring role for the railways in the logistics segment, it is imperative that the Railways commence involving the private sector in a meaningful and phased manner that offers a win-win to all stakeholders.”

Govt. proposes new SEZ lawReform to help States become partners in development: MinisterThe government on Tuesday proposed to replace the existing law governing special economic zones (SEZs) with a new legislation to enable States to become partners in ‘Development of Enterprise and Service Hubs’.The existing SEZ Act was enacted in 2006 with an aim to create export hubs and boost manufacturing in the country. However, these zones started losing their sheen after imposition of minimum alternate tax and introduction of sunset clause for removal of tax incentives.These zones are treated as foreign entities in terms of provisions related to customs. Industry has time and again demanded continuation of tax benefits provided under the law. Units in SEZs used to enjoy 100% income tax exemption on export income for the first five years, 50% for the next five years and 50% of the ploughed back export profit for another five years.Presenting the Budget 2022-23, Finance Minister Nirmala Sitharaman said: “The Special Economic Zones Act will be replaced with a new legislation that will enable the states to become partners in Development of Enterprise and Service Hubs.” This will cover all large existing and new industrial enclaves to optimally utilise available infrastructure and enhance competitiveness of exports, she noted.The government, she said, will also undertake reforms in customs administration of SEZs with a view to promote ease of doing business.“We will also undertake reforms in Customs Administration of SEZs and it shall henceforth be fully IT driven and function on the Customs National Portal with a focus on higher facilitation and with only risk-based checks,” the Minister said.This reform will be implemented by September 30, 2022.

MGNREGS allocation cut by 25% to ₹73,000 cr.

Move comes even as high rural unemployment prevails; grassroots activists highlight huge pending paymentsThe Centre’s ₹73,000-crore allocation for the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) in 2022-23 is 25% lower than the ₹98,000 crore Revised Estimate for the scheme in the current year, reverting to the same insufficient amount allocated in the last Budget. In fact, the MGNREGS did not find any mention during the Union Finance Minister’s Budget speech on Tuesday.Rural employment activists and non-BJP State governments reacted with outrage, accusing the government of crippling a key safety net during an employment crisis.The MGNREGS is a demand-driven scheme, guaranteeing 100 days of unskilled work to any rural household that wants it. During the first COVID-19 lockdown in 2020, when the scheme was ramped up and given its highest-ever budget of ₹1.11 lakh crore, it provided a lifeline for a record 11 crore workers. In the next financial year, 2021-22, the budget allocation dropped to ₹73,000 crore, resulting in the scheme running out of funds. Supplementary allocations then pushed up the Revised Estimates to ₹98,000 crore, but workers say they paid the cost in delayed wage payments and artificial suppression of demand, while some State governments were forced to dip into their own coffers to meet costs.“The cut comes at a time when the country is going through its worst-ever employment crisis. With the current allocation, we will have a repeat of last year, when the funds ran out mid-way through the year, and many crucial works will have to be stalled,” said Kerala Finance Minister K.N. Balagopal.“It is a terrible thing to do. But this is the Modi model of development,” added Amit Mitra, the Principal Chief Adviser to the West Bengal Chief Minister and a former Finance Minister of the State.Grassroots activists said the reduction in funding would have a disastrous impact on workers.

‘Wages unpaid’

“Approximately ₹12,300 crore — ₹1,464 crore as wages and ₹10,900 crore as material — is yet to be paid, which is going to eat up the next year’s Budget,” said Debmalya Nandy of the NREGA Sangharsh Morcha.“The government is using the Budget to kill the law,” said Nikhil Dey, a founder of the Mazdoor Kisan Shakti Sangathan.“This will hit the rural economy quite badly,” said Himanshu, a rural economist at the Jawaharlal Nehru University. “MGNREGA had saved the economy during the lockdown. The hope now is that with the economy slowly limping back to normalcy, demand for MGNREGA work may not be as high,” said D.K. Pant, chief economist at India Ratings. “However, rural wage growth is not keeping pace with inflation, and if the demand for work remains high, the government must be quick to provide supplementary funds,”

Digital varsity and e-content for schools planned

Experts, however, flag inequitable access to smart devices and two-year learning gap

Priscilla Jebaraj The Centre proposes to set up a digital university, develop e-content for schools and expand its educational TV channel scheme from 12 to 200 channels, Finance Minister Nirmala Sitharaman said during her Budget speech on Tuesday.

However, education experts say this focus on digital learning is misplaced, given the inequitable access to digital devices and the fact that children now returning to classrooms are facing a two-year learning gap.“Due to the pandemic-induced closure of schools, our children, particularly in rural areas, and those from Scheduled Castes and Scheduled Tribes and other weaker sections, have lost almost two years of formal education. Mostly, these are children in government schools,” the Finance Minister said.“We recognise the need to impart supplementary teaching and to build a resilient mechanism for education delivery,” she added.She announced plans to expand the educational television programme to allow for supplementary education in regional languages; to set up 750 virtual labs for science and mathematics; to develop high-quality e-content in all spoken languages for delivery via internet, mobile phones, TV and radio through digital teachers; and to create a mechanism to equip teachers with digital tools. The digital university will be built on a networked hub and spoke model, and will have collaborations with the best institutions in the country.“The immediate focus now, as children come back to physical classrooms, has to be on face-to-face teaching. Digital was essential during the lockdown, but we don’t have enough evidence to say what benefits it adds in comparison to in-person teaching,” said Rukmini Banerji, CEO of Pratham, an educational NGO that produces the Annual Status of Education Report.Dr. Banerji suggested that the priority in the year ahead must be on foundational literacy and numeracy.“One lesson the pandemic has taught us is that online teaching should not be confused with meaningful education. It may provide some engagement when schools are closed, but is pedagogically inferior to in-person learning, said Gurumurthy Kasinathan of the National Coalition on the Education Emergency.

New-generation anganwadis’ on the cards

Better infrastructure and audio-visual aids promised for 2 lakh child care hubs

Two lakh anganwadis across the country will be upgraded, Finance Minister Nirmala Sitharaman said in her Budget speech on Tuesday.In last year’s Budget, the government had renamed a few schemes and categorised them under ‘Saksham Anganwadi and Poshan 2.0’. Though the government is yet to share the details of the renamed scheme, the Finance Minister said it would include “new-generation anganwadis that have better infrastructure and audio-visual aids, powered by clean energy and providing improved environment for early child development”.Saksham Anganwadi and Poshan 2.0 includes anganwadi services, Poshan Abhiyan, a scheme for adolescent girls, and a national crèche scheme.The umbrella scheme has seen a negligible increase in Budgetary allocation of 0.7%. It has been allocated ₹20,263 crore for the next fiscal, compared to last year’s allocation of ₹20,105 crore.

Big on hopes, short on ideas

The Budget aims to focus on infrastructure and connectivity, but lacks growth-invigorating proposalsFinance Minister Nirmala Sitharaman’s fourth successive budget, while commonsensical in its approach, is not exactly bubbling with new ideas. With the economy still in search of durable momentum that could help entrench the recovery from the last fiscal year’s record contraction, Ms. Sitharaman has missed an opportunity to address the flagging consumer spending in the wake of erosion in real incomes and savings through a combination of tax breaks for the middle class and cash handouts for the poor. And even as the Minister acknowledges the role public capital expenditure could play in crowding-in private investment at a time when “private investments seem to require that support” and help to ‘pump-prime’ demand in the economy, the Budget outlay of ₹7.50 lakh-crore for the capital account marks just a 24.4% increase from the revised estimate of ₹6.03 lakh-crore for the current fiscal. To be sure, Ms. Sitharaman’s speech highlights the PM GatiShakti, a “transformative approach for economic growth and sustainable development” that is to be powered by the ‘seven engines’ of roads, railways, airports, ports, mass transport, waterways, and logistics infrastructure. While the broad sweep of the public infrastructure envisioned by the programme could potentially be truly transformative if it were to be executed as imagined, the Budget is largely short on details where it concerns the specifics and pencils in some figures only for the roads and railways components. The Budget lists a ‘Master Plan for Expressways’ that will be formulated in 2022-23 under the scheme and projects the addition of 25,000 kilometres of roads to the National Highways network. The talk of enabling seamless multimodal movement of goods and people and providing multimodal connectivity between mass urban transit systems and railway stations, however, all sound a familiar refrain from past speeches.Spending outlays on several other key sectors including health care, rural development and the vital jobs and income providing national rural employment guarantee scheme have all shrunk as a percentage of overall expenditure in the Budget estimates for fiscal 2023 from the revised estimates for the current year, even if in some cases only marginally. That these sectors have been forced to bear the impact of the Government’s keenness to broadly stick to a fiscal consolidation road map — with the Budget projecting a narrowing of the fiscal deficit to 6.4% of GDP in 2022-23, from a revised estimate for 6.9% — reflects on its priorities. Government spending on health care ought to have instead been significantly increased, with the lessons from the ongoing pandemic’s first two waves serving to illuminate the need for a sizeable enlargement of the public health infrastructure. A source of some solace, though, is the announcement of a ‘National Tele Mental Health Programme’ to address mental health problems that have been exacerbated by the claustrophobic lockdowns and plethora of anxieties triggered by the pandemic.

In a nod to the ruling party’s nationalist moorings and in line with the Government’s push to increase self reliance or AtmaNirbharta, the Finance Minister has proposed a series of tariff and policy steps that could help bolster domestic manufacturing in the long run. A key policy element is a commitment to reduce import dependence in procurement for the country’s defence forces. To that end the Minister has proposed earmarking 68% of the armed forces’ capital procurement budget to domestic industry in 2022-23, a not insignificant increase from the current fiscal’s 58% target. The tariff rationalisations, which cover a broad swathe of items ranging from electronics, gems and jewellery, chemicals, inputs used by MSME units and project and capital goods, could, however, have varying short-term impacts. Specifically, the move to phase out the concessional rates in capital goods and project imports gradually and apply a moderate tariff of 7.5% could in the short term hurt infrastructure projects and the setting up of new manufacturing capacity, some proposed exemptions for advanced machinery notwithstanding. The Minister has tried to address the raging debate over how to deal with virtual currencies by adopting a twin-track approach. On the one hand Ms. Sitharaman proposes to introduce in the coming fiscal year a Central Bank Digital Currency that she posits will impart a big boost to the digital economy and “lead to a more efficient and cheaper currency management system”. The RBI-issued Digital Rupee would leverage blockchain and other related technologies. In parallel, she intends to tax income from the transfer of any virtual digital asset at the rate of 30%, with deduction allowed only for the cost of acquisition. It remains to be seen if the Government’s efforts at bringing the mushrooming trade and investment in a multiplicity of virtual digital assets including cryptocurrencies under the tax net would have a salutary impact besides adding a revenue stream to the exchequer. The Minister’s latest budget also skirts mention of the asset monetisation plan mentioned in the last Budget and shows a sharp decline in capital receipts from disinvestment. With just ₹65,000 crore budgeted from asset sale for fiscal 2023, as opposed to ₹78,000 crore as per the revised estimates for the current fiscal, the Minister has had to increase gross borrowings to ₹14.95 lakh-crore, a 24% increase from the current fiscal’s budget estimate but a far sharper 43% jump from the revised estimate of ₹10.46 lakh-crore. The resource crunch manifest in the proposed higher debt issuance is ultimately bound to get more acute in the days ahead, given the Budget’s lack of growth-invigorating proposals.

A takeaway is the good infrastructure push

On the other side, the programme of fiscal consolidation does need further strengtheningThe clear emphasis in the Union Budget on expanding capital expenditure is a welcome directional change, particularly since 45.2% of fiscal deficit is being devoted to finance capital expenditure. This should help accelerate growth not only in the current year but also in the years to follow. However, the programme of fiscal consolidation needs further strengthening. As of now, it remains vague. A relook at the projected income growth for 2022-23 and its impact on revenue projections become necessary.

Perspectives on growth

The Centre’s 2022-23 Budget provides a nominal GDP growth estimate of 11.1% for 2022-23. The Economic Survey, on the other hand, had provided a real GDP growth range of 8%-8.5% for this year. Taking the lower end of the real GDP growth estimate of 8%, an implicit price deflator (IPD)-based inflation of 2.9% will deliver nominal growth of 11.1%. The real GDP growth of 8% may, however, be considered somewhat optimistic since 2022-23 would be the first normal post-pandemic year where any significant base effects may not be available. In fact, at the end of 2021-22, real GDP in terms of magnitude at ₹147.5 lakh-crore is estimated to only marginally exceed the corresponding level at ₹145.1 lakh-crore in 2019-20 using the NSO data released on January 31, 2022. In fact, in the second half of 2021-22, when there were no base effects, real GDP growth was only 5.6% using the latest available quarterly data. A real GDP growth of 7%-7.5% in 2022-23 appears to be more realistic. However, this may not undo the Budget’s nominal growth assumption of 11.1%. In fact, the IPD-based inflation may continue to be relatively high in 2022-23 since wholesale price index inflation rate is likely to remain high at least in the first half of 2022-23 as these are driven largely by the high prices of global crude and primary products. A more realistic assumption of IPD-based inflation of 5% and real GDP growth of 7.5% would have given a nominal GDP growth of nearly 13%.

Revenues and expenditures

According to 2021-22 (RE), the Centre’s gross and net tax revenues are estimated to grow at 24.1% and 23.8%, respectively. This indicates achieving a buoyancy of 1.4 in each case. In 2022-23 (BE) however, the buoyancy has been brought down to 0.9. Again, given the expanded digitisation and formalisation of the economy and the tax assessees, the Centre’s tax buoyancy may turn out to be higher than 0.9. If the under-assessment in both tax buoyancy and nominal GDP growth assumption are marginally corrected to say 1.1 and 13%, respectively, the Centre’s gross tax revenues would have grown more realistically by 14.3%. This would have created fiscal space for either raising expenditure growth or accelerating the reduction in fiscal deficit. In fact, in 2022-23, total expenditure is budgeted to grow by only 4.6% in which revenue and capital expenditures are budgeted to grow by 0.9% and 24.5%, respectively. This spells a welcome structural change in government expenditure in favour of capital expenditures. To the extent that these capital expenditures pertain to non-defence expenditures particularly in expanding construction and other infrastructure sectors, these would be associated with relatively high output and employment multipliers.

While the structural shift towards infrastructure expansion is quite welcome, it would have provided greater transparency had a medium-term assessment of the National Infrastructure Pipeline (NIP) been undertaken in the Budget indicating the sectors of deficient investment as compared to the original targets. The Budget provides for incentivising the States to expand their capital expenditures by permitting them a fiscal deficit limit of 4% of GDP; here, 0.5% points is marked for expanding power infrastructure. In addition, ₹1 lakh-crore has been allocated to States for capital expenditure in 2022-23 as 50-year interest-free loans, over and above the normal borrowings allowed to them.On the side of revenue expenditures, there is a reduction in budgeted total subsidies to 1.2% of GDP in 2022-23 from 1.9% in 2021-22 (RE). This is also a welcome structural change provided the food, fertilizer and petroleum subsidy numbers are not revised upwards during the course of the year due to the pressure emanating from high global crude prices. The burden of interest payments as a percentage of GDP has gone up from 3.5% in 2021-22 to 3.6% in 2022-23. In fact, interest payments may also come under pressure because of the Government’s increased gross and net borrowings from the market associated with high debt-GDP levels.

Debt and fiscal balance

According to estimates given in the Economic Survey for 2021-22, the general government debt relative to GDP is close to 90% at the end of 2021-22 and 2022-23. In the Medium-Term Fiscal Policy cum Fiscal Policy Strategy Statement attached to the Union Budget, the Centre’s debt at the end of these two years is estimated to be 59.9% and 60.2%, respectively. Thus, in spite of the fiscal deficit to GDP ratio going down from 6.9% to 6.4%, the debt-GDP ratio is still slated to increase in 2022-23. This may be marginally adjusted downwards if the nominal GDP growth increases above what is assumed in the Budget. Such high debt-GDP levels pre-empt a substantive part of the Government’s revenue budget. In fact, interest payments to revenue receipts ratio in 2021-22 and 2022-23 are 39.1% and 42.7%, respectively.The reduction in fiscal deficit relative to GDP by a margin of 0.5% points between these two years is a welcome directional change. The Medium-Term Fiscal Policy Statement indicates reaching a level of 4.5% by 2025-26. This implies an average rate of reduction of 0.63% points per year in the next three years. It would have been best for the Medium-Term Fiscal Policy Statement to clearly spell out the fiscal deficit adjustment path over the course of the next three to five years. In fact, given the Government’s high debt-GDP levels, the Centre’s Fiscal Responsibility and Budget Management (FRBM) Act requires it to be re-examined to recast the sustainable levels of debt and fiscal deficit and the adjustment path.C. Rangarajan is former Chairman, Prime Minister’s Economic Advisory Council and former Governor, Reserve Bank of India. D.K. Srivastava is Chief Policy Advisor, EY India, and former Director, Madras School of Economics. The views expressed are personal

A bold effort at public investment-led growth

But the Budget barely mentions the fall in share of private consumption in GDP and rising economic inequality

The Union Budget starts with a self-congratulatory announcement that India’s domestic output (GDP) is likely to grow 9.2% this year (2021-22) over last year — the highest among the world’s large economies. What is unsaid is that India’s output contraction the previous year (2020-21) was among the worst in the world. Compared to the pre-pandemic year (2019-20), the current year’s GDP will be marginally higher by 1.3%, as per the Economic Survey. If the adverse effect of the ongoing wave of the Omicron virus is factored in, the (estimated) modest rise in GDP may vanish. Thus, it is worth starting with the factually accurate picture that India lost two years of output expansion. In other words, per capita income today is lower than it was two years ago. Regarding sources of demand, the share of private consumption declined by three percentage points of GDP between FY2020 and FY2022. The Government stepped up its expenditure to mitigate the decline, but only modestly; hence, the marginal output expansion. In contrast, the United States boosted public spending by about 10% of GDP, and its output roared back!

This year’s Budget seeks to boost public investment by 35.4% at current prices over last year to raise its share in GDP to 2.9% from 2.2% last year. With grant-in-aid for state investments, the Budget hopes to increase public investment share to over 4% of GDP. The Budget hopes to trigger a virtuous investment-led output and employment growth by arguing in favour of the “crowding-in” effect of public investment on private investment. The theory is sound and is a welcome change from the past policy stance. The crux will be to mobilise resources to finance the investment as the Budget seeks to reduce the fiscal deficit ratio, as per the schedule laid out in the last Budget. The critical question is whether additional tax and non-tax revenue (that is disinvestment proceeds) will be sufficient to finance the investment plan.

To refresh our memory, last year too, public investment was sought to be raised by about the same proportion (34.5%). I had written, “These figures certainly look impressive. The realisation of these investments would crucially depend on tax revenue realisations, disinvestment proceeds, sale of rail and road assets and the Government’s ability to raise resources from the market, without raising interest rates for the private sector.” (https://bit.ly/3AWzxKP) It is ditto and holds for this year as well. Indeed, public investment has picked up in the current fiscal, by barely 0.2% of GDP. With the threat of higher (imported) inflation (on account of rising international oil prices) and rising interest rates (on account of the US Federal Reserve’s decision), meeting the ambitious investment target would be challenging, but it is worth attempting.

On the employment crisis

But the larger question is: how will it address the sharp decline (of three percentage points of GDP) in private consumption, which is likely to be caused by loss of employment? The derived demand for labour from an infrastructure boost may be limited, as the suggested projects are machinery intensive, not labour intensive. The Budget does not directly address the employment crisis caused by the novel coronavirus pandemic and the lockdown. The employment crisis would call for enhanced allocation for the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) and initiating a similar scheme for meeting urban unemployment. Instead, shockingly, the Government has slashed the allocation for MGNREGA by 25% over last year.

Industrial slowdown

The manufacturing sector’s share in GDP has been stagnating at around 15% of GDP for quite a while. The annual industrial growth rate has sharply slowed down from 13.1% in 2015-16 to minus 7.2% in 2020-21. Perhaps a most telling example of the industrial slowdown is the fall in two-wheeler sales. As per news reports, it fell to 11.77 million units in 2021, below 11.90 million units sold in 2014. Expectedly, employment has contracted, most of which in the informal or unorganised sector. Lack of demand is the real problem, with low capacity utilisation. Indeed, the proposed public investment would create demand for capital and intermediate goods. But if a substantial share of such investment “leaks” out as imports, then the industrial output may not get the desired boost.

It is essential to appreciate that India has become an import-dependent economy, especially on China. Despite the clarion call for Atmanirbhar Bharat, India’s imports have shot up. Research reports show that India’s trade deficit with China has gone up from $57.4 billion in 2018 to $64.5 billion in 2021. The figure would be much higher by China’s official trade account. And the deficit would be even higher if exports from China and Hong Kong to India are combined.

Premature on PLI scheme

India launched a production linked incentive scheme (PLI) for numerous technology-intensive products, starting with mobile phone assembly a few years ago to augment production and reduce imports. The Budget has mentioned the overwhelming response to the scheme. However, evidence on the number of such projects that have taken off, their investment and employment generation and rise in domestic content in such industrial units is too sparse. Hence, it is premature to claim the success of the PLI scheme.

India launched the “Make in India” initiative in 2014-15 to raise the manufacturing sector’s share in GDP to 25% and create 100 million new jobs in the industry by 2022. However, the Government diagnosed the principal barrier to increasing manufacturing in India as excessive and dysfunctional regulation holding back the private initiative.

The solution, it was argued, was to improve India’s rank in the World Bank’s Ease of Doing Business (EDB) index. India did splendidly to improve its rank — from 142 in 2014 to 63 by 2019-20. But the improved ranking failed the industrial sector miserably, with a steady slowdown, noted above. Last year, the World Bank scrapped the index as it was flawed globally and reportedly politically motivated (https://bit.ly/3HlaWSm).

Yet, the present Budget harps on improving the EDB index and reducing regulatory constraints on industry and infrastructure to boost growth. It appears shocking as the Government refuses to learn from past mistakes.

To sum up, the Budget for 2022-23 is a bold effort at public investment-led growth — quite similar to last year’s. The widely discussed concerns of the unemployment crisis, fall in the share of private consumption in GDP, and rising economic inequality (caused by the pandemic and the lockdown) have been barely mentioned in the Budget. Instead, the Budget pins its hope on investment to boost employment, as derived demand for labour. Without fully committed funds for capital investment, the success of the ambitious effort remains questionable.

Focus on accelerating growth with stability

The Budget is in the desired direction in the given circumstances, but its impact on the economy will depend on the efficiency of implementation

With the country yet again grappling with another wave of the COVID-19 pandemic, there are concerns about faltering growth and increasing unemployment. With international commodity prices, particularly crude oil prices, continuing to rise and with advanced economies draining liquidity and increasing interest rates, there is limited scope for monetary policy and heavy lifting of the economy, for growth acceleration must come from fiscal policy. It is in this context that the focus fell on the Budget to address the task of accelerating growth and creating new employment opportunities and the task of fiscal consolidation became secondary.

Accelerate growth, create jobs

The Budget for 2022-23 presented by the Union Finance Minister does not disappoint on this count. At 2.9% of GDP, the budgeted capital expenditure for 2022-23 is higher than the revised estimate for the previous year by 24.5% even as the overall growth of expenditure is just 4.6%. An increase of almost ₹1 lakh crore is for assisting the States to catalyse the development of infrastructure by giving them interest-free loans over and above the regular loans to be given according to Fiscal Responsibility and Budget Management limits. Most of this is for developing multi-modal transportation networks. In addition, about ₹60,000 crore has been budgeted for providing tap water for 3.8 crore households and another ₹48,000 crore for affordable housing. In addition to reviving the economy, many of these projects are employment-intensive and will help in reducing unemployment.

The increase in capital expenditure is to be accomplished even as the fiscal deficit is budgeted to be reduced from 6.9% in the current year to 6.4% in 2022-23. Of course, this is higher than the limit of 5.5% recommended by the 15th Finance Commission under a slow recovery scenario, but the Finance Minister in her Budget speech stated that the rate of consolidation will be faster in the coming years to reach a level below 4.5% by 2025-26. In fact, revenue deficit and primary deficit numbers are also budgeted to decline in the next year.

How realistic are these estimates? On the revenue side, the estimates look conservative. Total revenue receipts are estimated to increase by just 6% over the revised estimate and this is partly due to the high base figures as the revised estimate for 2021-22 is higher than the Budget estimate by 16.4%. On non-tax revenues, a sharp decline of 14% is budgeted mainly due to lower estimates of dividends from public sector enterprises and the Reserve Bank of India. On disinvestment proceeds, as against the budgeted ₹1.75 lakh crore in 2021-22, the revised estimate is placed at ₹78,000 crore and for the next year, it is budgeted at ₹65,000 crore. The critical question is whether the government will be able to contain the revenue expenditure growth next year at the budgeted level of less than 1%. In particular, the total subsidy bill for 2022-23 is budgeted lower by ₹1.15 lakh crore from the revised estimate of 2021-22 which includes a lower food subsidy of about ₹79,638 crore and fertilizer subsidy of ₹34,900 crore.

Tax proposals

On tax proposals, the most notable measure is the decision to levy tax on transactions in virtual digital assets in the hands of the recipient with 1% deducted at the source. Equally important measures are extension of tax incentives for start-ups by one year and extension of the commencement date for concessional tax for new entities by one year up to March 31, 2024, due to the delay in completion of the projects caused by the pandemic. On the personal income tax front, although there was a clamour for increasing the exemption limit, deductible allowances and rate brackets, the Finance Minister decided to maintain the status quo. Perhaps, in the interest of simplification, she should have rationalised the tax system by getting rid of the options of rate structure with and without incentives introduced last year and keeping only the one without the incentives with a lower rate and reducing the number of rate brackets to four including the exemption limit. There is a proposal to levy surcharge on long-terms capital gains uniformly at 15% for all types of capital assets. The Budget has also introduced a number of measures to reduce compliance burden, encourage voluntary compliance, reduce litigation, and improve the ease of doing business.

However, an important concern is the increasing protectionist trend and continued differentiation in import duties. Minute rate differences and taxing inputs at lower rates increase the effective rate of protection, adversely impact competitiveness and give rise to special interest groups lobbying for higher import duties. While the Production-Linked Incentive seems to be helping some of the newer industries and is helpful in increasing exports, it is necessary to erect a competitive wall rather than relying on scaffolding through incentives.

On the expenditure side, besides a significant increase proposed on capital expenditures, the PIL schemes for 14 sectors are expected to improve the competitiveness of Micro, Small and Medium Enterprises (MSMEs), help in increasing exports and create 60 lakh new jobs. Hopefully, the excessive protection and reservation given to MSMEs will not prevent them from becoming bigger and more competitive to take advantage of the scale economy. There are proposals to spend ₹2.37 lakh crore direct payment of MSP value to farmers’ accounts as well as ₹1,400 crore in 2022-23 on the Ken-Betwa river-linking project, create 100 new cargo terminals in the next three years, and during the year, build 25,000 km of highways.

In the right direction

By and large, the Budget is in the desired direction in the given circumstances. However, it must be noted that despite the hype regarding the Union Budget, almost 60% of the actual spending is at the State level. Besides, the impact of the Budget on the economy will depend on the efficiency with which the various proposals are implemented. Let us hope we will break the jinx of poor implementation.

A betrayal of the social sector when it needs help

The government seems to have prioritised meeting its fiscal deficit targets rather than using this opportunity to signal a path of employment-centred and inclusive growthIndia continues to rank poorly in various global indices that reflect the quality of life, human capital or human development in the country, such as the Human Development Index (rank 131 out of 189 countries) and the Global Hunger Index (rank 101 out of 116 countries). It is well documented that the pandemic over the last two years has had a severe impact on the health, education and food security of the poor and informal sector workers. A number of recent reports, including the Oxfam’s ‘Inequality Kills’ report and the ICE360 survey, well establish that the recovery in economic growth in India is K-shaped, meaning that the incomes of the poorer sections of the society are decreasing, while those of the richer sections are increasing. As many have argued, while this trend has been exacerbated by the pandemic, the country has been experiencing increasing inequality over the last couple of decades. Further, the period after 2016 has also seen stagnant real wages and increasing unemployment.

A conservative view

In this context, it was expected that the current Budget would see an expansion in government spending on the social sector. Greater spending on the social sector can contribute to improvements in human development outcomes, provide a cushion to people during the current economic crisis and also contribute to boosting private consumption demand which in turn can have a positive multiplier effect on the economy. However, despite the current situation of a demand crisis, the Budget has taken a conservative view and seems to have prioritised meeting its fiscal deficit targets rather than using this opportunity to signal a path of employment-centred and inclusive growth.

A complete disconnect

While it acknowledged that learning among children has been affected because of prolonged periods of school closures, the government announced that it will expand its ‘one class, one TV channel’ scheme instead of announcing enhanced allocations for schools so that they can reopen with vigour. This reveals a complete disconnect with the situation on the ground where school infrastructure needs upgradation, teacher vacancies need to be filled and efforts need to be made to bring back children who have dropped out of school and also have huge learning losses to catch up on.This is also reflected in the lower spending in the last two years as seen in the revised estimates (RE). The budget for school education at ₹63,449 crore is a slight improvement over last year’s ₹54,873 crore (2021-22 budget estimates, BE) and a mere increase of 6% in nominal terms compared to 2020-21 BE of ₹59,845 crore. After a grand announcement rechristening the school mid-day meal scheme as Pradhan Mantri Poshan Shakti Nirman, simply called PM Poshan, the allocation for the scheme has reduced from ₹11,500 crore last year to ₹10,233 crore this year.In the midst of a pandemic, and despite repeated statements about strengthening the public health system, the overall budget for the Department of Health and Family Welfare at ₹83,000 crore has gone up by only 16% over the BE for 2021-22 and by less than ₹1,000 crore compared to the RE for 2021-22, which is ₹82,921 crore. However, by including water and sanitation in the budget for health, there is an increase being shown in health spending as a proportion of GDP. While spending on the drinking water mission is also extremely important, for the sake of consistency it cannot be clubbed with the health budget. Also, even though the budget for the Jal Jeevan Mission has increased from ₹50,000 crore to ₹60,000 crore, only 44% of the allocated funds to the Department of Water and Sanitation for 2021-22 has been spent as on end December 2021.Through the pandemic period, the Public Distribution System has been a lifeline for many, although only 60% of the population are covered by ration cards currently under the National Food Security Act. Those who were eligible benefited from the additional free foodgrains that they have been given under the Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY). However, the food subsidy (BE) for 2022-23 at ₹2.06 lakh crore is only enough to cover the regular NFSA entitlements. The indication is that there is no plan to extend the PMGKAY. The food subsidy RE for 2021-22 is ₹2.86 lakh crore.Budgets for important schemes such as Saksham Anganwadi, maternity entitlements and social security pensions are around the same as the allocations for last year. The allocation for MGNREGA at ₹73,000 crore also does not reflect the increased demand for work or the the pending wages of ₹21,000 crore.

Continued negligence

On the whole, in the Budget for 2022-23, the social sector has once again been betrayed while this is perhaps a time when it needs the most support. As seen above, the resources allocated for crucial government schemes in the fields of health, education, nutrition, and social protection have remained stagnant or show negligent increase. In fact, the budgets for these schemes have been declining in real terms since 2015. India already starts off from a weak position of having very low spending in the critical areas of social protection, education and health. For instance, the World Social Protection Report 2020-22, brought out by the International Labour Organization, shows that the spending on social protection (excluding health) in India is 1.4% of the GDP, while the average for low-middle income countries is 2.5%. Budgets on health and education have also been low, much below the desirable levels of 3% and 6% of the GDP. This continued negligence does not bode well for inclusive development in India.

A Budget that sends mixed signals on health

While the Budget promotes social determinants of health, there is less than anticipated increase for health programmesThough the Finance Minister referred to the Omicron variant of COVID-19 and the need to maintain caution, the clear signal that emerged from the Budget is that COVID-19 is no longer perceived to be a major threat and that the post-COVID-19 phase of development must focus on capital-intensive infrastructure projects. The commitment to primary healthcare that was strongly articulated in the Budget of 2021 was much more muted this year.

Definition of health

The Finance Minister expanded the conventional definition of health in her presentation of the Budget of 2021, when she included water, sanitation, nutrition and air pollution control. The Economic Survey, released a day before this year’s Budget, reported that expenditure on health reached 2.1% of GDP with an annual increment of 0.4% in the last two years. This suggests that we are on track to reach the government’s target of 2.5% by 2025. Recent increases represent both the redefined accounting categories and the COVID-19-related attention to augmented health services. Whether the health sector by itself will display a budgetary momentum of increased allocations was a feature of interest before the Finance Minister rose to present this year.Supply of tap water to 38 million more homes will be welcome and so will the provision of housing under the Pradhan Mantri Awas Yojana and initiatives for pollution control which include expansion of zero emission public transport services, incentives to reduce crop stubble burning and battery-swapping policy. These along with expansion of digital classroom support to schools across the country will promote the social determinants of health.

Need for higher investment

For the health programmes themselves, there has been less than anticipated increase. The National Health Mission received a 7.4% increase over the money expended last year. With a large need to strengthen both rural and urban primary care, this is disappointing. There is a need to galvanise the Urban Health Mission which has moved slowly thus far. A number of rural and urban Health and Wellness Centres need to be established and activated with staff, equipment and supplies. While some of it will come from the infrastructure mission, the requirement of trained human resources calls for higher investment.The allocation for the Pradhan Mantri Jan Arogya Yojana (PMJAY) stays unchanged at ₹6,412 crore. The expenditure last year was ₹3,199 crore. This represents a 100% increase. The scheme fell short of utilising its allocated budget for the past two years because of reduction in non-COVID-19 care under its payments and also because of the limited number of accredited hospitals in Tier-2 and Tier-3 urban locations and rural areas. It does not also cover the cost of outpatient care and medicines outside a hospital setting. Unless these limitations are overcome, mainly private sector hospitals in well-developed urban locations will be able to utilise it.The Health Infrastructure Mission has got an allocation of ₹5,156 crore. Since its launch in October last year, it has spent ₹900 crore. Since the mission has projected an expenditure of ₹64,120 crore over six years, the allocation seems to fall short of ambition. Perhaps, next year’s Budget will show catch-up growth. The Pradhan Mantri Swasthya Suraksha Yojana, which focuses on expansion of tertiary care facilities, has been allocated a 35.1% increase, keeping in with the promise of an AIIMS in every State and upgrading of several medical college hospitals.AYUSH has been given a 14.5% increase, while the Department of Health Research sees an increase of only 3.9%. This is surprising, given the impetus given to continuing need for COVID-19 research and development of new vaccines. There is also a need for health systems and implementation research to support effective delivery of national health programmes that span communicable diseases, maternal and child health, nutrition, non-communicable diseases and mental health. Development and evaluation of appropriate and affordable health technologies too would be in keeping with the spirit of Atmanirbhar.The Digital Health Mission has an allocation of ₹200 crore. Given the potential and promised services under that mission, the allocation appears sub-optimal. However, there is a welcome initiative to establish 23 Telehealth centres to provide support for mental health services across the country. The National Institute of Mental Health and Neurosciences (NIMHANS) at Bengaluru will coordinate these services. The International Institute of Information Technology (IIIT) in that city will provide technical support. While this is a much-needed initiative, mental health services must extend even to those who are not digitally enabled. That requires strengthened primary care services everywhere.Vaccines for COVID-19 received an allocation of ₹5,000 crore as against ₹39,000 crore the previous year. This suggests that the government believes that all the eligible persons who need to be vaccinated through public funding will receive the vaccines in the current financial year and that there would be no major threat which would call for large-scale investments in new vaccine procurement. Since the government has granted market licensing to Covishield and Covaxin, the policy indicates that the private sector would be the principal source for providing additional vaccines to those who may seek it. If there is a resurgence of COVID-19 due to a new threatening variant, a special package may be needed. At present, that does not appear to be highly probable.To end on an appreciative note, the Finance Minister deserves plaudits for providing tax relief to differently abled persons, whose parents or guardians have crossed the age of 60 years. This takes into account the fact that employment and the earning capacity of the person who provides such support usually diminishes at that age.