The News Editorial Analysis 24th Jan 2022

Omicron in community transmission: INSACOG

‘Most cases mild, but hospitalisations, ICU cases up’Omicron is now in community transmission in India and has become dominant in multiple metros, where new cases have been rising exponentially, the Indian SARS-CoV-2 Genomics Consortium (INSACOG) said in its latest bulletin on Sunday.INSACOG, jointly initiated by the Union Health and Family Welfare Ministry, the Department of Biotechnology and others, is a consortium of 38 laboratories monitoring the genomic variations in SARS-CoV-2, the novel coronavirus causing COVID-19.The two-page bulletin, dated January 10 and released on Sunday, says while most Omicron cases so far had been asymptomatic or mild, hospitalisations and ICU cases had been increasing in the current wave. The threat level remained unchanged.

The recently reported new SARS-CoV-2 variant — B.1.640.2 — lineage was being monitored, it added and said there was no evidence of rapid spread and while it had features of immune escape, it was currently not a variant of concern. “So far, no case detected in India,” the bulletin said.BA.2 lineage, it added, was a substantial fraction in India and S-gene dropout-based screening was thus likely to give high false negatives. Tests suitable for PCR-based screening applicable to all Omicron lineages had been approved. S-gene drop-out was a genetic variation like that of Omicron.

False dichotomy

The top court’s view that quotas ensure equal opportunity is a blow for affirmative action

The Supreme Court has once again addressed the ‘merit versus reservation’ debate, a misleading binary that has engaged public and judicial discourse for years. While ruling in favour of extending reservation to OBCs in the all-India quota (AIQ) of seats in admission to under-graduate and post-graduate medical and dental courses, the Court has concluded that the binary has become superfluous. The courts have now come to recognise the idea of ‘substantive equality’, which sees affirmative action not as an exception to the equality rule, but as a facet of the equality norm. ‘Formal equality’, or the principle that everyone competes on an equal footing, is inadequate to address social inequalities and the inherent disadvantages of the less advanced sections, necessitating provisions that help them compete with the advanced classes. The competitive examination may be necessary for distribution of educational opportunities, but it does not enable equal opportunity for those competing without the aid of social and cultural capital, inherited skills and early access to quality schooling. Good performance in an examination does reflect hard work, but does not always reflect “merit” solely of one’s own making. “The rhetoric surrounding merit obscures the way in which family, schooling, fortune and a gift of talents that the society currently values aids in one’s advancement,” writes Justice D.Y. Chandrachud, and raises the relevant question whether marks are the best gauge of individual merit. Seen in this light, reservation ensures that backward classes are able to avail of opportunities that “typically evade them because of structural barriers”.

The provision of 27% reservation for OBCs within the AIQ was introduced only in July 2021. Implemented from 1986, the AIQ was envisaged as a domicile-free quota to access medical education in all colleges in the country. It comprises 15% of undergraduate medical and dental seats and 50% of post-graduate seats surrendered by the States for admission through a central pool. For two decades, there was no reservation in this segment. In 2007, the Court allowed the introduction of 15% reservation for SCs and 7.5% for STs. Even when the OBC quota was introduced in Central government institutions alone, there was none in State colleges. The decision to end this discrimination now has judicial imprimatur. The Court has also rejected the argument that there was no need for reservation in post-graduate medical education. The impact of backwardness, it has said, does not simply disappear because a candidate has a graduate qualification and does not create parity between advanced classes and backward classes. The latest judgment marks another notable addition to the body of affirmative action jurisprudence.

A chance to support growth, fiscal consolidation

Two years of real growth in economic activities have been wiped out by COVID-19, which the Budget must take note ofThe National Statistical Office (NSO) released the first advance national accounts estimates for 2021-22 on January 7, 2022. India’s real GDP growth in 2021-22 is estimated at 9.2%, that is 30 basis points lower than the projection by the Reserve Bank of India and the International Monetary Fund (IMF) projection of 9.5%. In an earlier analysis (The Hindu, December 18, 2021, “The challenge of achieving 9.5% growth rate”), we had considered some of the ongoing challenges to the 2021-22 growth forecast, indicating a possible decline. The adverse effect of the third wave of COVID-19, which is mainly affecting the last quarter of 2021-22, may call for a further downward adjustment in the growth rate to about 9%. The main sectors that have held back a more robust recovery are trade, transport, et al. on the output side and private final consumption expenditure (PFCE) on the demand side as their annual estimated 2021-22 magnitudes remain below the corresponding levels in 2019-20.

Growth prospects

With respect to the prospects of 2022-23 growth, IMF and Organisation for Economic Co-operation and Development (OECD) forecasts have indicated growth rates at 8.5% and 8.1%, respectively. However, these may prove to be optimistic as the base effects characterising 2021-22 may be limited. In fact, as per the NSO’s advance estimates, at the end of 2021-22, the magnitude of GDP in real terms is estimated at INR₹147.5-lakh crore that is only a shade higher than INR₹145.7-lakh crore in 2019-20. Thus, due to the three waves of COVID-19 that India has experienced, two years of real growth in economic activities have been wiped out. The economy has to now start on a clean slate. Growth in 2022-23 would depend on the basic determinants such as the saving and investment rates in the economy. As per the advance estimates, the gross fixed capital formation (GFCF) relative to GDP at current prices stands at 29.6% in 2021-22. Capacity utilisation in India continues to have considerable slack. Available quarterly data indicate a capacity utilisation ratio of only 60% at the end of the first quarter of 2021-22 and an average of 61.7% in the preceding four quarters. As such, a pick-up in private investment may take some time.

Private final consumption expenditure (PFCE) also shows a low growth of 6.9% in 2021-22. Any pick-up in demand would continue to be constrained by low-income growth in sectors characterised by a high marginal propensity to consume (MPC) such as the trade, transport, et al. sector and the Micro, Small and Medium Enterprise (MSME) sector more broadly. Growth in 2022-23 would also continue to be constrained by supply-side bottlenecks and high prices of global crude and primary products. It may thus be prudent to expect a real GDP growth in the range of 6%-7%. The implicit price deflator (IPD)-based inflation which was as high as 7.7% in 2021-22, may come down to about 5%-6%. Thus, we may expect a nominal GDP growth of about 12%-13% in 2022-23. It is the nominal magnitude which is crucial as far as the Budget is concerned.

It was due to the high IPD-based inflation that the nominal GDP growth in 2021-22 at 17.6% exceeded real GDP growth by a margin of 8.4% points. This high nominal growth combined with base effects resulted in the Centre’s gross tax revenue (GTR) growth of 50.3% during the first eight months of the current fiscal year. In the first six months of 2021-22, this growth was even higher at 64.2%. In October and November 2021, the average growth in the Centre’s GTR fell to about 17.4% as the base effect was weakening. We assess that the annual growth in the Centre’s GTR may be close to 35%, implying a buoyancy of nearly 2. With these buoyant tax revenues, the Government may be able to limit the 2021-22 fiscal deficit to its budgeted level of 6.8% of GDP although a marginal slippage may not be ruled out. There may be some slippage in disinvestment targets and supplementary expenditure demands have also to be accommodated.Going forward, since the base effects in the Centre’s GTR would have weakened, we may expect a lower annual GTR growth of about 15%-16% in 2022-23 which in combination with a nominal GDP growth of 13% implies a buoyancy of about 1.2. This would still compare well with the Centre’s GTR growth performance in the pre-COVID-19 years which averaged only 5.6% during 2017-18 to 2019-20. The major corporate income tax (CIT) reform undertaken in 2019-20 had provided, among other things, a concessional CIT rate of 15% for fresh investment in manufacturing by domestic companies provided their production took off on or before March 31, 2023. As nearly two years have been lost due to COVID-19, the Government may consider extending the time limit for availing this benefit. The GST compensation provision would also come to an end in June 2022. This would cause a major revenue shock at least for some States such as Tamil Nadu, Kerala and Andhra Pradesh. While this matter may be considered by the GST Council, the compensation arrangement should be extended by two years in some modified form. Its impact on the Centre’s Budget should be provided for.With respect to non-tax receipts, the scope of the National Monetization Pipeline (NMP) may be extended to cover monetisation of government-owned land assets. Disinvestment initiatives may have to be accelerated.

Expenditure priorities

Expenditure prioritisation in 2022-23 should focus on reviving both consumption and investment demand. The National Infrastructure Pipeline (NIP) should be reassessed, and its path may be recast in order to make up for existing deficiencies in relation to the original targets — particularly in the health sector. In this regard, the infrastructure investment undertaken by State governments and the public sector should be realistically ascertained and shortfalls with respect to original targets may be identified and remedial measures initiated. Since consumption demand remains weak, some fiscal support in the form of an urban counterpart to Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) may be considered in addition to supporting some of the sectors which are directly impacted by COVID-19. Revival of the economy in 2022-23 would critically depend on containing the adverse economic impact of the third wave of COVID-19 — and subsequent waves — to a minimum.

Return to fiscal consolidation

It would be appropriate now to consider a graduated return to fiscal consolidation while using fiscal policy to lay the base for faster growth in the years to come. The Fifteenth Finance Commission had suggested a fiscal consolidation path where the Centre’s fiscal deficit was benchmarked at 5.5% of GDP for 2022-23. In their pessimistic scenario, it was kept at 6% of GDP. At this point, while supporting growth is critical, signalling a return to fiscal consolidation is also important. It may be prudent to limit the reduction in fiscal deficit-GDP ratio to about 1% point of GDP in 2022-23. This would imply a fiscal deficit in the range of 5.5%-6% of GDP. From here on, a stepwise reduction of 0.5% points per year would enable a level of about 4% of GDP by 2025-26. By this time, as suggested by the Fifteenth Finance Commission, a high-powered inter-governmental group should be constituted to re-examine the sustainability parameters of debt and fiscal deficit of the central and State governments in the light of new empirical realities, particularly taking into account the likely level of interest rate on government debt.

- Rangarajan is the Chairman, Madras School of Economics and a former Governor of the Reserve Bank of India. D.K. Srivastava is the Chief Policy Advisor, EY India and a former Director of the Madras School of Economics. The views expressed are personal

A stellar fallacy

Assessment of environmental costs, benefits of projects should not be done in haste

A move by the Union Environment Ministry to implement a ‘star-rating system’ has sparked controversy after one of its official communiqués became public. Under this scheme, State-level environment committees that appraise industrial projects on their potential environmental risk would be incentivised with points for “transparency, efficiency and accountability”. This idea followed a Union Cabinet meeting this month to facilitate the Government’s broader commitment to ‘Ease of Doing Business’. The Environmental Impact Assessment (EIA) is one of the cornerstones of ensuring that the ecological costs of infrastructure development are minimal. Prospective projects above a certain size and with a potential to significantly alter the natural environment must be first approved by the State Environment Impact Assessment Authority (SEIAA) comprising State officers and independent experts. Projects that are even bigger or involve forest land — category A — must be cleared by an expert committee formed by the Centre. SEIAA projects make up the bulk of projects for approval including building and construction, small mining, small industry projects, and are considered ‘less polluting’.

The star rating system proposed is to “rank” and “incentivise” States on how quickly and “efficiently” they can accord environmental clearances. It spells out seven criteria to rate SEIAAs on “transparency, efficiency and accountability”. On a scale of 7, an SEIAA, for instance, gets more points for granting a clearance in less than 80 days than for within 105 days and no marks for more. A score of seven or more would be rated ‘five star’. However, a reading of the order gives the impression that States, in the quest for more stars, would logically vie for speedily clearing projects rather than ensure a thorough appraisal. The Environment Ministry, has said, in response to criticism, that the intention is not to hasten clearances but accelerate the pace of decision making. Rather than files being sent back for every query, all objections must be compiled and addressed at one go, it contends. While quicker decision-making benefits everyone, State committees are currently hampered by having too few independent experts and decision-making being left to bureaucrats than to environment specialists. Both industrialists and States gain from projects and, therefore, the tendency is always to elide environmental concerns. In many instances, site visits are critical to understand the potential environmental challenges. Calculating the risks and the benefits of industrial projects vis-à-vis their environmental impact is understandably hard. The way forward is to take steps to increase trust in the system and ensure that all States have competent experts who can conduct appraisals without fear or favour. A list of empty rankings is the least advisable way to bring about this.

Budgeting for the education emergency

It is astonishing that public expenditure data on the education sector are not easily availableIn the current Budget session, how much money the Central and State governments will allocate to education and for what purpose should be a matter of public concern and debate. Even before the pandemic, public spending on education in most States was below that of other middle-income countries. Most major States spent in the range of 2.5% to 3.1% of State income on education, according to the Ministry of Education’s Analysis of Budgeted Expenditure on Education. This compares with the 4.3% of GDP that lower-middle-income countries spent, as a group, between 2010-11 and 2018-19. Low-income countries increased their spending from 3.2% to 3.5% of GDP in the same period (World Bank, Education Finance Watch, 2021).

Spending on education

Faced with an unprecedented education emergency, this is the time to substantially ramp up public spending on education and make it more effective. Inexplicably, however, in the 2021-22 Budget, in the midst of the gravest education crisis, the trend was in the opposite direction for the Central government and many State governments. The Central government’s allocation for the Education Department was slashed compared to the previous year, even though the size of the overall budget increased. Of the major States and Delhi, eight either reduced or just about maintained their budget allocation for education departments in 2021-22 compared to 2020-21. Seven States marginally increased their allocation by 2%-5%. Only six States increased their allocation by more than 5%, though it remains to be seen how actual expenditures compare with budget allocation.

The education system now needs not only an infusion of resources for multiple years, but also a strengthened focus on the needs of the poor and disadvantaged children. The vast majority of the 260 million children enrolled in preschool and school, especially in government schools, did not have meaningful structured learning opportunities during the 20 months of school closures. They have lost basic literacy and numeracy skills, and even the habit of learning. Millions have disengaged from education, due to lack of contact with teachers. Even when schools started re-opening in October, they were operating only at half schedule. Some States have still not opened primary schools. In anticipation of the Omicron wave, State governments rushed to close primary schools first in early January 2022, contrary to all international trends.

Increased public spending alone is a necessary but not sufficient condition to address all these problems. What it is spent on and how effectively resources are used are important. It is clear what additional resources are required for. The needs include: back-to-school campaigns and re-enrolment drives; expanded nutrition programmes to address malnutrition; reorganisation of the curriculum to help children learn language and mathematics in particular, and support their socio-emotional development, especially in early grades; additional learning materials; teacher training and ongoing support; additional education programmes and increased instructional time during vacations and weekends; additional teachers and teaching aides, where required, in part to cope with transfer of students from private schools; and collection and analysis of data.

Many State governments and the Central government have been spending public resources to use technology in education. This is a good time to ask how much of public resources was/is being spent on technology and how effective it was during the pandemic, when less than 20% of all students could access even prerecorded videos. How does expenditure on technology compare with the amounts spent on teacher training, which represents just 0.15% of total estimated expenditure on elementary education? Teachers are central to the quality of education, so why does India spend so little on teacher training?

The disaster caused by the pandemic could be the opportunity to reverse the chronic under-funding of India’s public education system. UNESCO’s 2030 framework for action suggests public education spending levels of between 4% and 6% of GDP and 15%-20% of public expenditure. A recent World Bank study notes that India spent 14.1 % of its budget on education, compared to 18.5% in Vietnam and 20.6% in Indonesia, countries with similar levels of GDP. But since India has a higher share of population under the age of 19 years than these countries, it should actually be allocating a greater share of the budget than these countries.

Opacity of data

How does India’s public education expenditure “effort” compare with the UNESCO indicative benchmarks? The opacity of education finance data makes it difficult to comprehend this. For instance, the combined Central and State government spending on education was estimated to be 2.8% of GDP in 2018-19, according to the Economic Survey of 2020-21. This figure had remained at the same level since 2014-15. On the other hand, data from the Ministry of Education indicates that public spending on education had reached 4.3% of GDP in the same year, rising from 3.8% of GDP in 2011-12.

The difference in the figures is due to the inclusion of expenditure on education by departments other than the Education Department. Including expenditure on education by, for example, the Ministry of Tribal Affairs, the Ministry of Social Justice and Empowerment (on Anganwadis, scholarships, etc.), the Ministry of Science and Technology (for higher education) is of course legitimate. But many of the other departments comprise a smorgasbord. No fewer than 43 Ministries and Departments of the Central government are supposed to be spending on education. Education expenditure by other departments has been rising faster than that by the Education Department, at both Central and State level. They constitute one-quarter of the education expenditure by the States in 2018-19, and half of the Centre’s expenditure on education.

However, the composition of these expenditures is not readily available. Public expenditure on elementary education (about 1.8% of GDP) and for other levels of education are rough estimates. The reason is that other than the Education Ministry, education expenditures of departments are not shown by level. They are somewhat arbitrarily assigned to different levels of education and estimated by the Central government. The estimation of education expenditure by other departments of the State governments is even more crude, as they do not even provide separate expenditures on education. The ratio of education spending in other departments at the Central level is used to estimate this for each of the States.In an era of data deluge, it is astonishing that public expenditure data on the education sector are not easily available. But the questions for this Budget should be clear. How much additional funds are being allocated for different levels of education by the principal departments in 2021-22? Are the funds being spent on the specific measures required to address the education emergency facing the children who have been deprived of learning opportunities?

Petition on conjugal rights pending for months in SC

It assumes importance amid debate on marital rapeA petition questioning a law that forces a woman to return to her husband and denies her sexual autonomy has been pending in the Supreme Court for months without a hearing.Restitution of conjugal rights, considered a medieval ecclesiastical law from England codified in several statutes, including the Hindu Marriage Act and Special Marriage Act, owes its survival largely to the fact that marital rape is not recognised as crime.The petition, titled Ojaswa Pathak versus Union of India, was last heard on July 8, 2021. Justice Rohinton Nariman, who had led the Bench, has since retired.

The furious debate to criminalise marital rape compels a thought on how restitution of conjugal rights, though gender-neutral, places an additional burden on women by forcing her to stay with her husband and threatens their bodily autonomy, privacy and individual dignity. If a woman does not comply to return to her husband, the court could even attach her property.Provisions of restitution of conjugal rights empower a husband or a wife to move the local district court, complaining that the other partner has “withdrawn” from the marriage without a “reasonable cause”.The provisions violate a woman’s freedoms of association, to reside anywhere in the country and practice a profession.

That is, if a woman stays away from her husband for her job, would it mean that she has “withdrawn” from the marriage. Besides, “reasonable cause” is subjective.The courts have dealt with conjugal rights in a chequered manner.The Punjab and Haryana High Court in Tirath Kaur case, held that “a wife’s first duty to her husband is to submit herself obediently to his authority and to remain under his roof and protection”.The Supreme Court, in Saroja Rani case, held that the “right of the husband or wife to one another’s society is inherent in the very institution of marriage”.

New lease

The fight against marital rape and restitution of conjugal rights has gained a new lease of life with the Supreme Court’s nine-judge Bench upholding privacy as a “constitutionally protected right”.The top court, in its recent Joseph Shine judgment, concluded that the State cannot interfere in a person’s private affairs and “privacy is an inalienable right, closely associated with the innate dignity of an individual, and the right to autonomy and self- determination to take decisions”.The time is ripe for the top court to pick up from where it left off.

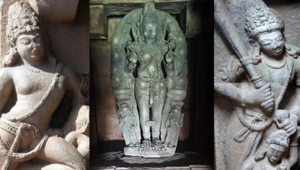

Archaeologist and epigraphist Nagaswamypasses away at 92

He was instrumental in protecting several monumentsR. Nagaswamy, the first Director of the Department of Archaeology, died of age-related complications on Sunday. He was 92, and is survived by two daughters and two sons.

An authority in archaeology, architecture, epigraphy, numismatics, iconography, south Indian bronzes and temple rituals, Nagaswamy favoured the idea of closing temples in Tamil Nadu during the COVID-19 pandemic. He would say that ahamic principles allowed such closure during mahamari (epidemic), fire, earthquake and invasion. “Invoke the God in a tharpai [tarpaulin] and worship in a private place,” he said.Nagaswamy was born at Kodumudi in Erode district, an abode of Lord Siva sung by Saivate saints. But he would take pride in saying, “K.P. Sundaramabalukkumengaooruthan [It is also the birthplace of actor and singer K.P. Sundarambal].”He had deep knowledge of Tamil and Sanskrit. He obtained his MA in Sanskrit from the University of Madras. He was awarded a Ph.D. in Indian arts by Pune University. After serving the Department of Archaeology in various capacities, he became its Director in 1966 and held the post till his retirement in 1988.

Nagaswamy, whose name was synonymous with archaeology, was always available for his views on South Indian history, its temples, ahamas, Chola bronzes and the shastras of Bharatanatyam. He penned a book, Masterpieces of Early South Indian Bronzes, in 1983 and compiled a coffee-table book for the Tamil Nadu government to mark the World Classical Tamil Conference. His other important books are on Mamallapuram, published by the Oxford University Press, Uthiramerur and Gangaikondacholapuram. He had also published books in Tamil.According to his website tamilartsacademy.com, Nagaswamy was instrumental in protecting several historical monuments, including the Chera inscriptions at Pugalur, the palace site of Gangaikondacholapuram, the famous 17th century Thirumalai Nayak Palace in Madurai, the Danish Port at Tranquebar and the birthplace of national poet Subramania Bharati in Ettayapuram. He oversaw excavations at the palace site of VeerapandiyaKattabomman at Panchalankurichi and at Korkai.

Peru declares environmental emergency following oil spill

Waves from Tonga eruption hit a tanker unloading at refineryPeru declared an environmental emergency Saturday to battle an oil spill caused by freakwaves from a volcanic eruption in the South Pacific.The stunningly powerful eruption on last Saturday of an undersea volcano near Tonga unleashed tsunami waves around the Pacific and as far away as the United States.In Peru, the oil spill near Lima has fouled beaches, killed birds and harmed the fishing and tourism industries.

With its 90-day decree, the government said it plans “sustainable management” of 21 beaches tarred by 6,000 barrels of oil that spilled from a tanker ship unloading at a refinery last Saturday.One aim of the decree is to better organise the various agencies and teams working in the aftermath of the disaster, the Environment Ministry said.

$50 million losses

Foreign Trade and Tourism Minister Roberto Sanchez estimated on Saturday that economic losses total more than $50 million, all sectors combined.

The government is demanding payment of damages from the Spanish energy giant Repsol which owns the refinery.The environment ministry said 174 hectares — equivalent to 270 football fields — of sea, beaches and natural reserves were affected by the spill. Crews have been working for days to clean up the spill.

But the Ministry said it issued the emergency decree because the crude still in the water was still spreading, reaching 40 kilometers from the spot of the original spill.

The Environment Ministry said “the spill amounts to a sudden event of significant impact on the coastal marine ecosystem.”

What mutual fund SIPs are really about

They make you invest, automates that investment and keeps you building wealth over the yearsAt about ₹5.65 lakh crore, the mutual fund systematic investment plans (SIP) accounts for 15% of the total mutual fund assets under management (AUM).That’s higher from the 13% share in April 2021. SIP AUM has grown at almost double the rate that the entire mutual fund AUM has between April and December 2021, with monthly SIP amounts breaking past ₹10,000 crore last September.All this is welcome! SIPs are great ways to invest and build wealth. But along the way, the SIP, its purpose and benefits have become somewhat contorted. So, here’s putting SIPs in perspective — what they are and how they really help you.

Committed investments

In a SIP, you are putting money into a fund at regular intervals through the year. You knew that already. But what you’re also probably discounting is the true benefit of this.

A SIP’s biggest advantage is that it makes sure you invest every month.

It makes sure that you don’t overspend and skimp on saving. It doesn’t give you the excuse to put off investing for the next month. For the salaried especially, with income coming in every month, SIPs are the best way to ensure that investments happen.

More, by investing smaller sums every month, SIPs allow you to slowly and surely build up wealth.Large financial goals are hard to reach with lumpsum investments for most of us! As your income grows, raising your SIP amounts – and AMCs and investment platforms provide several handy ways in which you can increase SIP amounts – will improve your wealth-building and see to it that savings keep in step with rising income.

Not a cure

But the emphasis on SIPs over the past few years have pushed down this fundamental benefit and elevated others, giving SIPs an identity that’s often misunderstood.

Take the ‘rupee cost averaging’ benefit. In reality, averaging costs down doesn’t play out easily. To genuinely average costs lower, two factors are needed. First, markets should correct. Second, you need that market fall to continue for long (or be steep) enough so that you’re able to make enough additional SIPs at those low levels such that your overall investment costs shift lower.When you run SIPs through a market upswing, your costs are in fact moving up as you’re investing at steadily higher levels. Longer the rally, the more your cost trends upwards and the more you need a correction to lower costs.

The longer you run your SIP, the more you need a long market downturn to average, since your investment amount itself is likely to be large.Next, consider the benefit that SIPs are the solution to investing at the wrong time. Yes, SIPs help reduce the risk of investing at highs when stocks are peaking, as SIPs allow investing at different NAVs and market levels. But, this often gets twisted into the belief that SIPs prevent losses or that they ensure high returns. That doesn’t happen.SIPs are a mode of investment. You don’t invest in an SIP. You invest in a fund through an SIP. Your investment is the fund. Your return will be that of the fund. If a fund is unable to deliver well, having invested through SIP is not going to improve that return. If markets are correcting, so does your fund and your investment.

To extend this point further, you also don’t have ‘SIP funds’ or ‘lumpsum funds’ for the same reason. SIPs and lumpsums are only methods of investing in a fund and are not the investment itself. You only have good funds that are worth investing in, whether it is through SIP or lumpsum.With equity markets on a tearing run for close to two years now, and with no prolonged corrective period even before that, it’s important not to lose sight of what SIPs are and are not. Having lofty or faulty expectations from your SIP is likely to disappoint you, make you lose faith in your investments should markets take a breather this year.

This can push you into stopping SIPs, the one thing you shouldn’t do. You need to run your SIPs through a market correction to truly get their ‘averaging’ effects.

Not always needed

The mistiming risk and averaging benefit is also uniformly applied to all funds, making SIPs out to be the only way or the right way of investing. No. Again, look at what SIPs do.

SIPs reduce risk of investing highs. But this high risk of mistimed investments is primarily only in equity funds (and aggressive hybrid funds). Only stock markets can drop sharply or stay down for a long time. Mistiming risk is minimal or very short-lived in all debt funds (other than gilt funds) and in hybrid categories other than aggressive hybrid.

Similarly, it is only in equity funds/hybrid aggressive funds that you can turn market volatility to your advantage, by investing on dips and lowering costs. In the absence of that volatility, you get no averaging benefit; in such funds, as long as your timeframe is right, it doesn’t matter whether you invest through SIP or lumpsum.Therefore, remember the fundamental advantage and need for an SIP, which is that it makes you invest, automates that investment, and keeps you building wealth over the years. Don’t focus excessively on other aspects that may not apply and may only confuse you or leave you disappointed.

No stopping the growth of Cryptos

They have been writing obituaries for cryptocurrencies for almost a decade now. But they refuse to die so easily. On the contrary, the whole crypto ecosystem is growing bigger by the day. During the last nine years or so, the total market cap of cryptocurrencies has gone up from $1.5 billion (in May 2013) to $1,668 billion (on 22 January 2022). Bitcoin prices during that period have risen from less than $200 a piece to over $35,000 as of 22 January 2022, reaching the peaCryptos have acquired all the paraphernalia of a legitimate financial asset with dedicated exchanges, hedge funds and asset management companies. The US even has Bitcoin futures ETF trading on exchanges. In what many are calling financialisation of cryptos, some ‘banks’ in the US are even giving interest as high as 9% on Bitcoin deposits—all these amidst fear of an imminent government crackdown on the whole crypto ecosystem, globally.k levels of $68,000 in between.So far, we have seen stray action taken by some countries against activities related to cryptos. But barring a few like China—which banned mining and trading cryptos, and conversion of legal tender into them—not many have taken a very clear stance against these private digital currencies. Regulators in different countries have been making discordant noises against these currencies, but none of them have been able to say with conviction how they are going to deal with the Frankenstein monster. In fact, they are not even sure if they should call it a monster at all.So we are in a situation where the interest in them continues to grow despite the heart-stopping volatility in that market, and the ecosystem around them is getting more sophisticated. We have now reached a stage where large institutional money is being funnelled into the digital currency market through hedge funds and asset management companies, making it all the more difficult for governments to act in a decisive manner against them. The obituaries might still be written till some country comes up with a set of regulations, finally legitimising them. Who knows, with the Budget around, India could take the lead in legitimising cryptos by announcing tax rules for gains made on them.